A Business Organized as a Separate Legal Entity Is a

Added 6152015 95610 PM. What you can read next.

Click On The Image To View The High Definition Version Create Infographics At Http Venngage Com Accounting Principles Accounting How To Create Infographics

A business organized as a separate legal entity is a.

. Has tax advantages over a proprietorship or partnership. Log in for more information. Who to understand a setting through contact with people in it.

Add an answer or comment. You will probably choose the sole proprietorship form for your marketing agency. Asked Feb 25 in Accountancy by Kamal 132k points A business organized as a separate legal entity is a a.

Is owned by its stockholders. A limited liability company LLC can be a corporation and basically it refers to a private company in which the owners are legally responsible for the companys debts but only to the amount of capital he or she has invested. No personal liability of the owners for businesss debts.

Terminates when one of its original stockholders die 46. A business organized as a corporation A is not a separate legal entity in most states. A business organized as a corporation ais not a separate legal entity in most states.

Answered Feb 25 by Haren 148k points Best answer. A corporation is a separate legal entity. A business organized as a separate legal entity is a.

Requires that stockholders be personally liable for the debts of the business. Brequires that stockholders be personally liable for the debts of the business. Dterminates when one of its original stockholders dies.

Deb Smith is the proprietor owner of Smittys a retailer of athletic apparel. No personal liability b. What you can read next.

Accounting communicates financial information about a business to both internal and external users. Correct option is a. Confirmed by jeifunk 6162015 61641 AM Comments.

The primary purpose of the statement of cash flows is to provide information about the cash receipts and cash payments of a company for a specific period of time. Stock- holders may transfer all or part of their. Log in or sign up first.

A business organized as a separate legal entity is a a. Favorable tax treatment d. Place an Order Now.

A business organized under state law that is a separate legal entity. Stockholders are not personally liable for the debts of the. A business organized as a separate legal entity from its owners is a corporation.

A business organized as a corporation is not a separate legal entity in most states. A business organized as a separate legal entity is a. Which of the following would not be considered an internal user of accounting data for the Sultan Company.

PSY 275 Week 3 Anxiety and Stress Disorders Worksheet. Place an Order Now. Requires that stockholders be personally liable for the debts of the business.

Share It On Facebook Twitter Email 1 Answer. A business organized as a corporation a. Corporation b proprietor c.

A business organized as a separate legal entity is a. Is not a separate legal entity in most states. Corporations have one or more owners called stockholders.

Is not a separate legal entity in most states. Log in for more information. We Accept these Payments Format and Free Features Approx.

A business organized as a separate legal entity is a a. The LLC can be referred to as a hybrid business entity that combines the limited. It is simple to set up and gives you control over the business.

Sh hare your windo w. Confirmed by jeifunk 6162015 61641 AM Comments. The term separate legal entity is the basic legal concept underlying business law and legal liability.

Merchandise inventory clerk d. It is organized independently of its owners. Hair and Rent Comparison.

Which of the following is not an advantage of the corporate form of business organization. C is owned by its stockholders. Step-by-Step Report Solution Verified Solution cis owned by its stockholders.

Clas10 1 Answer Get Answers Chief of LearnyVerse 231k points. A business organized as a separate legal entity is a a. B requires that stockholders be personally liable for the debts of the business.

A business organized as a separate legal entity owned by stockholders is a partnership. Easy to transfer ownership C. Cis owned by its stockholders.

A business organized as a separate legal entity is a corporation. That is they are not personally liable for the debts of the corporate entity. Log in or sign up first.

Another legal entity is a person known by regulation as a legal entity. Added 6152015 95610 PM. This person may be a company a partnership with unlimited liability or any.

This answer has been confirmed as correct and helpful. A business organized as a separate legal entity is a corporation. Add an answer or comment.

A business organized as a separate legal entity owned by stockholders is a. Basically an SLE means that if someone takes legal action against your business your personal finances are. There are no comments.

A business organized as a separate legal entity under state corporation law and having ownership divided into transferable shares of stock is a corporation The holders of the shares stockholders enjoy limited liability. A business organized as a separate legal entity owned by stockholders is a corporation. There are no comments.

Small owner-operated businesses such as barber shops law offices and auto repair shops are often sole proprietorships as are farms and small retail. If you played sports when you were young then you grew up and entered the workforce already knowing how incredible it feels to be part of a team. Get An Answer to this Question.

The entity has the legal rights and responsibilities of the individual apart from the person who leads and or proudly owns the entity. This answer has been confirmed as correct and helpful. D has tax advantages over a proprietorship or partnership.

Easy to raise funds 3. Is owned by its stockholders. STEP BY STEP Why Us Money-Back Guarantee Plagiarism-free papers.

Business organized as a separate legal entity Problem 1. President of the company. Discussion 2 44 Why Us Money-Back Guarantee Plagiarism-free papers Affordable Prices and Discounts High Quality Papers FREE Revisions Professional Writers 247 Support Team.

For small businesses credit cards are a valuable financial tool that business owners can use to. A separate legal entity is when you and anyone involved in your company are separate from your business for legal purposes.

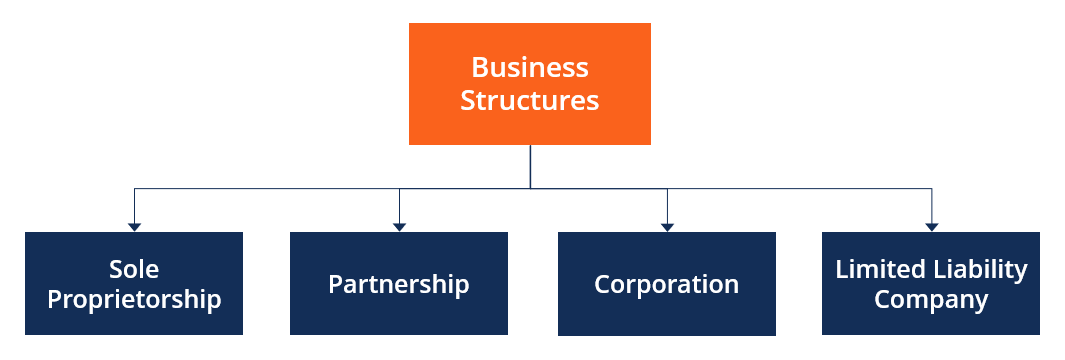

Business Structure Overview Forms How They Work

A Limited Liability Partnership Combines The Advantages Of Both The Company And Partnership Into A Single F Limited Liability Partnership Partnership Liability

Healthcare Providers Need Data Model Flexibility Now Learn Why They Re Turning To Nosql Document Stores Http P Relational Database Data Healthcare Provider

Today S Chief Compliance Officers Ccos Face More Responsibility Than Ever But Also An Opportunity To Play A More Strate Risk Management Job Title Compliance

What Is A Separate Legal Entity Definitions Examples More

Acc 560 Week 3 Homework Potato Chips Gourmet How To Apply

Sole Proprietorship Registration Sole Proprietorship Is A One Person Business Who Possesses Manages And Controls The Sole Proprietorship Business Start Up

Comments

Post a Comment